Chicago/Hong Kong, October 2017 - Mr. Govert Heijboer and Mr. Tobias Hekster, both co-CIO of True Partner Capital share their view on the growing popularity of 'short'.

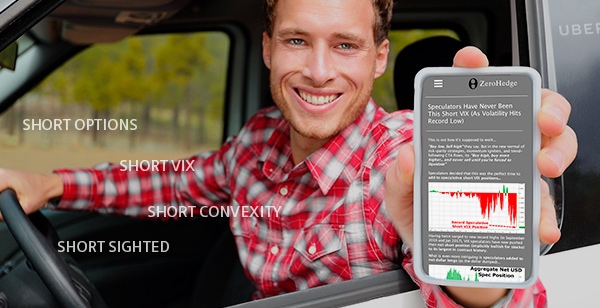

Risk Premia, and in particular the short VIX and other short volatility trades are basking in ever-increasing popularity. Even the man on the street is piling his money in. A New York Times article recently mentioned a new generation of day traders focusing on the VIX.

Remember the famous anecdote of Joe Kennedy who exited the stock market in 1929 after he started getting stock tips from his shoeshine boy? Well, average Joe has now discovered shorting VIX. Given the VIX now trading at ultralow levels, it is an interesting point in time put a historical perspective on today’s exuberant markets. Markets and their volatility especially have proven to be cyclical.

When something extreme happens, like these historically low levels of the VIX, often the phrase coined: this time it is different. The answer is yes and no. Yes, a different bubble and no, this one will also not last. Importantly, we are recognizing some aspects of volatility that we have seen before in the markets, which we would like to share

Shorting volatility can be self-fulfilling if done large enough… but

Please allow us to take you back in time to our pit-trading years. Once upon a time, the ‘Fortis crowd’ as the collective market makers in this Dutch insurance company’s stock options were referred to, was stuffed with 40,000 October 30(at-the-money) put options. A brave seller sold such a large amount of options that all market makers who had a similar position in this stock were long convexity up to our armpits. And come the October expiry, all the market makers who diligently ‘delta hedged’ would offer to sell stock above 30, and purchase stock below 30. As a result, Fortis remained ‘pinned’ at 29.95 – 30.05 for the last week. Much to our chagrin we saw the time value of our expiring options melt away, like chocolate in a toddler’s hand.

This phenomenon makes sense, as the amount of shares underlying these contracts was significant compared to daily volumes traded in Fortis. But this phenomenon was also referred to in a sideline of JP Morgan’s Kolanovic research paper which briefly roiled markets last July. There is more quantitative evidence pointing out that a side effect of the large volatility short interest is a smothering of market movement due to delta hedging.

Just like the Fortis Crowd was overwhelmed by the amount of volatility sold, the market of the world’s benchmark and most liquid instrument, the S&P 500 looks to be in a similar bind either by direct selling in S&P 500 index options or in products indirectly doing the same - namely the VIX index futures and short VIX index ETFs. And as banks have refrained from their traditional warehousing function due to Dodd-Frank, the excess supply is picked up by the market makers or hedge funds such as True Partner Fund. And we instill a non-directional discipline by delta hedging.

This becomes part of a self-sustaining trend. When collective delta hedging smothers realized volatility, the short volatility trade looks more appealing and thus the recent implied volatility below 5% on the short-term (weekly) S&P 500 options looks like an interesting short attracting even more participants worried to miss out on these potential returns.

However, it has come to the point that with such a low implied volatility a mere 2% correction in one day has become a “six sigma event”. For a generation of traders who experienced 2008 or even the more ‘benign’ moves of the Nasdaq bubble and the 2011 debt crisis, it is evident that while this trade might be profitable at the moment, it is pretty clear that the amount of risk associated with these trades might not be well understood. Given the current liquidity traders expect to be able to cut losses quickly. But just like the sea completely subsides showing vast tracts of land before a tsunami hits, market liquidity tends to be equally gone when a shock hits.

Games of chicken never end well

Another aspect of these old floor trading days springs to mind regarding short volatility positions. At times when the crowd would be collectively short volatility, a sort of silent collusion took place. If the share price would move up, we collectively needed to purchase shares to hedge. But doing so would further push up the share price, resulting in a vicious circle. Thus, we collectively held our breath and very delicately tried to pick up some shares. But in a nice practical implementation of game theory, this does not hold as the first more aggressive buyer of shares gets a better deal than the competition. Always, one local trader would try to lift an offer setting in motion a buying frenzy hurting all involved. Nowadays the Crowd does not see each other, but sits anonymously behind screens, giving a much higher chance of such a vicious circle to happen.

Positive feedback loop likely starts with a correction of more than 2-3% in S&P 500

A little number crunching. When an investor currently sells a weekly at-the-money straddle in the S&P 500 for about 14 points his break-even-points would be 14 points higher or lower than the current level. It is reasonable to assume the investor would not let his or her losses run compared to a maximum profit of 14 points that such a straddle give if the S&P 500 does not move at all. Hence, there will be a point where he or she will hedge: buying futures going up or selling futures going down. And if the S&P 500 starts to resemble the options crowds from times past, the latter point becomes relevant too: at what point will the less experienced market participants choke.

Circling back to recent research papers, the thesis has been made that a 3.5% gap opening would do the trick. We dare to be more aggressive. Current implied volatilities are as low as 5% and the post-2008 new trading generation who only saw implied volatilities go down have a different view on risk management as stress tests of a daily 5% correction would probably be considered at the moment a 10-15 sigma event and hence seen as “impossible”. With this in mind the inflection point where forced hedges ought to be starting to impact might be closer to 2% and might just as well occur on an intraday basis. But we do subscribe to the potential swift further sell-off that would follow.

The current equilibrium of earth-shattering calm has other drivers as well, which are frequently touted. ‘Controlled Volatility Funds’ which tend to increase exposure in rising markets and cut down risk in declining markets. How quaint, Portfolio Insurance is back. Open interest in the ‘VIX roll down trade’ of which the XIV EFT is just the retail version, results in crowding effects, such as the 8-minute rip of over 10% on August 11th. The prevalence of ETF investing which is the tide lifting all indices, but also provides the ease of bailing out of a position by the flip of a few buttons when someone shouts ‘fire’. And last but not least the quest for yield, bidding up illiquid assets and thus setting the stage for an unpleasant correlation event when the eventual unwind takes place. Remember the all but forgotten story of Long Term Capital Management’s demise.

Buy cover and head for the hills? Not so fast!

What to do with this analysis? These days “exciting new contrarian” long volatility offerings sprout like mushrooms. However, investors should be aware of newcomers touting a free call option….for themselves. When markets remain quiet the investor loses, and when the correction occurs the long volatility manager shares in the spoils. Conventional wisdom has it that recognizing bubbles and market imperfections is only part of success; timing is essential and nearly impossible.

This makes investing in volatility two-headed, like the mythological Chimera. On one head, be prepared for market turmoil but on the other avoid large losses from time decay of holding long option positions while awaiting “doomsday”. As a fund manager with a track record over 6 years, we apply a relative value approach for a reason. This philosophy applies to both the True Partner Fund as well as the long volatility biased True Partner Volatility Fund. Our 24/5 trading approach is combined with our advanced trading technology that includes a real-time adaptive quantitative model and real-time risk management allowing us to quickly adapt to a sudden change in market circumstances.

If there is a lesson from the past year and especially the last 12 months, it is that widely feared events have fizzled quicker than before. A Trump presidency? Tax cuts galore, not just disfunction and strife. North Korean missile cruising over Japanese airspace while conducting a nuclear test larger than all the previous ones combined? Been there, done that. Shrinking the Federal Reserve balance sheet? There’s always the ECB and the Bank of Japan to pick up the slack. But when what one fears does not materialize, what one doesn’t know will eventually do the trick. Many market participants have identified the volcano, but continue their profitable dance on top of it. But as all parties, this one will end in tears following an unexpected event, likely labeled another ‘six-sigma event’ that only in hindsight everyone saw coming….

––––––––––––––––––––––––

About the authors

Mr. Govert Heijboer, Co-CIO of True Partner, has been active as a market maker trading in the European and Asian derivatives markets as well as positional trading since 2003. Govert started as a trader/researcher at Saen Options in Amsterdam and rose to become the director of derivatives trading and a member of the executive team in 2007. In 2008 he moved to Hong Kong to set up and assume responsibility for all trading activities in the new Saen Options Hong Kong branch office. Govert holds a PhD in Management Science and an MSc in Applied Physics from the University of Twente, Netherlands. He is a founding partner and has worked on the launch of the True Partner Fund since March 2010.

Mr. Tobias Hekster, Co-CIO of True Partner, has been actively trading for the past 18 years in various different roles in several markets across the globe. Starting at IMC in 1998 as a pit trader in Amsterdam, Tobias has established the off-floor arbitrage desk, headed the Chicago office in the transition from floor trading to electronic trading and set up the Asian volatility arbitrage desk in Hong Kong. Tobias holds an MSc in Economics and he teaches as an Adjunct Associate Professor at the Chinese University of Hong Kong and as an Adjunct Professor of Financial Practice at National Taiwan University.

–––––––––––––––––––––––––––––––

The publication of this article is available as a PDF. Download it by following the link below:

True Partner Capital - Is your Uber driver starting to give you tips on selling vol?>>

Copyright© True Partner Capital, True Partner Advisor 2017. All rights reserved.

- Are we heading to a new ICE Age?

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- More news articles >

- Go to events >