So far, 2022 has served a rather unappetizing stew of continued supply chain issues, war in continental Europe, crypto distress and continued inflationary readings feeding into rapidly rising bond yields. Against this backdrop, in June, the S&P 500 and Euro Stoxx 50 indices flirted with a bear market (down around 20% year-to-date) as the post-Covid optimism of 2021, which lifted the S&P 500 an impressive 27% last year, appeared to have faded. Since mid-June, markets have rallied in the optimistic expectation that the current path of moderate rate hikes will contain inflation, while allowing for the gentlest of soft landings.

But amid the negative headlines and storm clouds, one surprise has been the muted response of equity index volatility. One common indicator is the VIX index, which measures 30-day S&P 500 implied volatility. Despite the S&P 500 being down close to 10% year-to-date at the time of writing, the VIX is little changed year-to-date at 19.7 vs 17.2 at year-end 20211. The VIX September future (the current front-month contract) is down year-to-date, declining from 26.3 at the end of 2021 to 23.4 as of 16 August 2022. It peaked at just over 30 in mid-June, when the S&P 500 was down 22% YTD. In contrast during the equity drawdown in early 2020 the VIX jumped from 14 to over 80 in around four weeks.

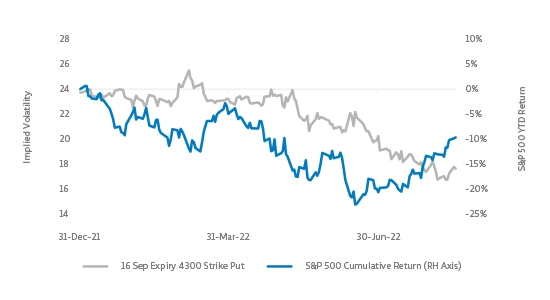

When looking at the VIX, it is important to recall that the VIX is primarily based on taking a snapshot of at-the-money implied volatility. When the underlying equity market falls, the reference strikes used to calculate the VIX change, moving lower. These lower strikes typically trade at a premium to at-the-money options. Thus, changes in the VIX are driven both by changes in the reference strike as well as changes in ‘per-strike’ implied volatility, i.e. the volatility of individual options. Therefore, when the market declines and the VIX remains unchanged or even falls (which we have seen in several weeks this year) that typically means ‘per strike’ volatility has declined quite meaningfully. Thus, it is also useful to look at the volatility of individual options. The below chart shows the volatility of the current at-the-money contract (the S&P 500 September 4300 Put) as well as the underlying index year-to-date. Notably, the implied volatility of this contract has decreased from 24% to approximately 18% despite the market’s decline.2

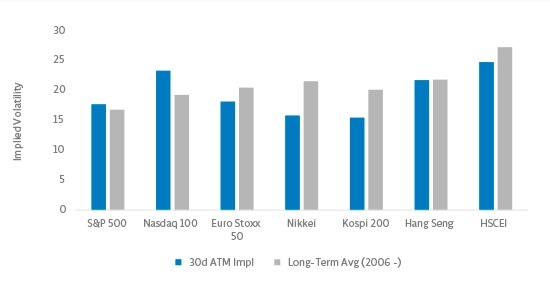

This development was not limited to the US, but also occurred in several others, including the Euro Stoxx 50 and Korea’s Kospi 200 (both of which are down around 10% or more year-to-date). As a result, despite the equity declines, equity index implied volatilities are currently generally only around their long-term averages, with some Asian markets below.3 This is a contrast to implied volatility behaviour in some other asset classes: for example, the MOVE Index of US Treasury implied volatility is substantially above its long-term average.4

But not only at-the-money volatilities have compressed. In early 2022, it was notable that downside skew (the degree to which market participants are prepared to pay more for downside protective strikes) was relatively expensive, which we saw as indicative of end-users holding hedges. Monetization of these hedges appeared to be one factor in the muted responsiveness of volatility in earlier market troughs. But for those who were waiting for bigger moves, holding volatility hedges has been a surprising ‘pain trade’ this year. Now the pendulum appears to have swung to the other side, as the current volatility structure appears to indicate less hedges held by end-users: dealer positioning on the downside is light and skews, if anything, are depressed historically. In other words, likely more investors are now ‘swimming naked’.

Interestingly, the developments in volatility and skew make now a more favourable entry point for any protective strategies applying volatility hedges, not least as one aspect of lower volatilities and skews is that the bar for a severe market surprise is lowered. In the current volatility landscape, a 3.5% decline in the S&P 500 would already constitute a three-sigma event, which would likely stir options markets to a larger extent than what we’ve seen earlier this year.

That brings us to what to expect for the coming months. In our view, unabating inflation and the increasingly hawkish central bank responses remain the markets’ key focus. While the Federal Reserve has commenced its tightening cycle, as recently as late March the median of the FOMC participants’ projections suggested the Fed Funds rate would peak below 3%. Since then, inflation data has mostly continued to surprise on the upside. But the current expected peak of just over 3.5% would still be low by historical standards. While inflationary pressures have generally been low since the 2008 Global Financial Crisis until recently, prior real rates were more significantly positive and tightening cycles usually ended with notably higher real interest rates. Thus, the risk of central banks still being behind the curve is tangible. In Europe, the ECB has a particularly tough job, with high inflation, growth concerns and the risk of fragmentation limiting the ECB’s ability to raise rates, while even the ECB staff union has been complaining that pay is not sufficiently protected against inflation.5

While markets price a velvet-like soft landing, doubts also remain on the economy itself. Inflationary data has been interspersed with recessionary signals, including the whopping miss of US GDP and deterioration of the US housing markets (itself somewhat of a deja-vu from the late 2000’s). Furthermore, the main gist of the second quarter earnings season ‘not being as bad as feared’ does not inspire confidence for the upcoming quarter. Besides all this, there is the unfortunate prospect of severe energy shortages across Europe in the coming winter season. With inflation still looming large, the traditional role of government bonds as a ‘safe-haven’ still seems challenged, despite already substantial losses for bonds YTD.6

In these times of uncertainty volatility can be a useful component to any investment portfolio. Volatility strategies can be both a source of return and a diversifier. The asymmetric pay-off patterns of options allows for inefficiencies to exist in volatility markets, as market participants can trade the same option with different objectives, but also because of the complexities involved: relative value volatility analysis can require large volumes of data and an understanding of individual market nuances, flows and liquidity dynamics.

An additional benefit of options is the ability to customize a strategy and portfolio to the objectives of the investor, for a more tailor-made solution. Where managers have the right capabilities, customization can enable volatility strategies to be tailored and combined to meet specific portfolio objectives, such as protecting against tail risks. This can further enhance diversification benefits and potentially achieve better overall portfolio outcomes.

Net, as we approach a still uncertain market environment, there is a silver lining in the subdued equity index volatility response seen so far in 2022: the current market configuration presents a more attractive entry point for considering equity index volatility strategies, particularly relative to other asset classes. For savvy investors, this could offer the potential to enhance risk-adjusted returns.

–––––––––––––––––––––––––––––––

About the authors

Mr. Govert Heijboer, Co-CIO of True Partner, has been active as a market maker trading in the European and Asian derivatives markets as well as positional trading since 2003. Govert started as a trader/researcher at Saen Options in Amsterdam and rose to become the director of derivatives trading and a member of the executive team in 2007. In 2008 he moved to Hong Kong to set up and assume responsibility for all trading activities in the new Saen Options Hong Kong branch office. Govert holds a PhD in Management Science and an MSc in Applied Physics from the University of Twente, Netherlands. He is a founding partner and has worked on the launch of the True Partner Fund since March 2010.

Mr. Tobias Hekster, Co-CIO of True Partner, has been actively trading for the past 22 years in various different roles in several markets across the globe. Starting at IMC in 1998 as a pit trader in Amsterdam, Tobias has established the off-floor arbitrage desk, headed the Chicago office in the transition from floor trading to electronic trading and set up the Asian volatility arbitrage desk in Hong Kong. Tobias holds an MSc in Economics from University of Groningen, Netherlands. Next to his role as Senior Strategist, he taught as an Adjunct Associate Professor at the Chinese University of Hong Kong and as an Adjunct Professor of Financial Practice at National Taiwan University.

Mr. Robert Kavanagh, CFA, Head of Investment Solutions of True Partner, has been in the hedge fund industry since 2004 and joined True Partner in 2019. Prior to joining True Partner he was an Executive Director at Goldman Sachs Asset Management where he spent 15 years within the Alternative Investments & Manager Selection (AIMS) group. Robert has extensive experience investing in hedge funds and working with a wide range of hedge fund investors. Robert is a CFA charterholder and holds a First Class (Honours) BSc in Philosophy and Politics from the University of Bristol, UK, where he was awarded a Social Sciences Scholarship.

–––––––––––––––––––––––––––––––

The publication of this article is available as a PDF. Download it following the link below:

If the market ain’t broken, Vix it before it will>>

–––––––––––––––––––––––––––––––

1. As of 16 August 2022

2. Data as of 16 August 2022 unless stated. LH axes show implied volatility at mid prices Nothing herein constitutes an offer or a solicitation of an offer to purchase a security. Past performance does not guarantee or indicate future results. Sources: True Partner, Bloomberg.

3. Uses 30-day at-the-money implied. Long-term averages use data from January 2006 to 16 August 2022. Data as of 16 August 2022 unless stated. Sources: True Partner, Bloomberg.

4. Using the same period of Jan 2006 to 16 August 2022

5. ‘Lagarde spurns ECB staff plea for pay rises linked to prices’, Bloomberg News, 9 May 2022

https://www.bloomberg.com; see also ‘ECB Staff Union Demands More Pay to Guard Against Inflation’, Bloomberg News, 24 Nov 2021 https://www.bloomberg.com

6. For example, the Bloomberg US Treasury: Long index of 10Y+ maturity government bonds is down -20% YTD as of 16 August 2022

- Are we heading to a new ICE Age?

- AI Top or Slop: When Markets Reach Peak Magnificence

- The Hedge Fund Journal features True Partner's award-winning volatility strategies

- True Partner Fund wins award for strong performance

- True Partner releases new thought piece focused on Dutch pension funds

- True Partner Fund nominated for best performing relative value fund

- Bloomberg article highlights True Partner’s strong performance in April and year-to-date

- Bloomberg Publication: True Partner Volatility Hedge Fund Gains 5.9% During April Rout

- True Partner to join the London Volatility Investing Event 2025

- Wat zijn de gevolgen voor pensioenfondsen van een zware beursdaling?

- More news articles >

- Go to events >